In recent years, online shopping has undergone a significant transformation, becoming an integral part of modern consumer behavior. With the rise of e-commerce platforms and digital payment methods, consumers now have unprecedented convenience and accessibility when making purchases online.

Also Read: What 5 Advertising Trends Are Changing The Way We Promote?

One notable development in this landscape is the increasing popularity of virtual cards, which have emerged as a versatile and secure payment option for online transactions. In this article, we will explore the key characteristics that make virtual cards a convenient and preferred means for online purchases.

Main Advantages of Virtual Cards

Virtual cards offer several distinct advantages that make them an attractive choice for online shoppers. Firstly, they provide enhanced safety and security when used on the internet, offering protection against fraud and unauthorized transactions. Additionally, virtual cards are incredibly easy to create and are instantly ready for use, eliminating the need for physical cards or lengthy activation processes. Moreover, virtual cards offer unparalleled flexibility in terms of settings and limits, allowing users to customize their spending parameters according to their individual needs and preferences.

How to Choose the Best Virtual Card for Online Shopping

When selecting a virtual card for online shopping, several key parameters should be considered. These include security features, ease of use, cost of maintenance, and the availability of additional functions. By evaluating these factors, users can ensure they choose a virtual card that meets their specific requirements and offers the best value for their money.

The Importance of Having No Limits on Replenishment and Spending

One crucial criterion when choosing a virtual card for online shopping is the absence of limits on replenishment and spending. This feature ensures users have the flexibility to manage their finances effectively and make purchases without constraints. For example, in situations where large transactions or frequent purchases are common, having no limits on replenishment and spending can provide added convenience and peace of mind.

Comparative Analysis of Popular Virtual Cards

There are several popular virtual cards available on the market, each with its own set of features and advantages. Let’s take a closer look at some of these cards to better understand their main characteristics and benefits:

PSTNET as an Example of an Ideal Solution for Online Shopping

PSTNET provides the best virtual card for shopping and stands out as an exemplary solution that meets all the criteria outlined for an optimal virtual card service adapted for online shopping. With the help of PST NET, users receive many benefits aimed at improving the quality of their purchases.

The PST service offers a multitude of advantages that cater to the modern user’s needs and preferences:

- Easy Registration: Experience seamless onboarding with easy registration options, including login via Google, Telegram, WhatsApp, and Apple accounts, ensuring a hassle-free start to your journey.

- Instant Crypto Top-up: Embrace the world of cryptocurrency with instant top-up capabilities using USDT, BTC, and over 15 other coins, providing flexibility and convenience for transactions.

- Responsive 24/7 Support: Enjoy peace of mind with fast and responsive customer support available round the clock via Telegram bot, WhatsApp, and email, ensuring prompt assistance whenever required.

- Enhanced Security Measures: Prioritize security with features like a Telegram bot for service notifications and a robust two-factor authentication system, safeguarding your account and transactions from potential threats.

- Generous Transaction Limits: Experience the freedom of high transaction limits, with each transaction amounting up to $100k, coupled with no restrictions on monthly expenses, empowering you with flexibility in managing your finances.

- Versatile Ultima Card: Unlock limitless possibilities with the Ultima card, designed to cater to various payment needs. From subscribing to work services to booking vacation tickets and indulging in online shopping across platforms like ChatGPT, Spotify, Taobao, and more, the Ultima card offers unparalleled versatility and convenience for your payment needs.

Revolut Virtual Card

Revolut Virtual Card: Revolut offers virtual cards as part of its digital banking platform, allowing users to make secure online transactions. Revolut virtual cards are known for their strong security features, including the ability to freeze and unfreeze the card instantly via the mobile app. They also offer real-time spending notifications and currency exchange at interbank rates, making them ideal for international shoppers.

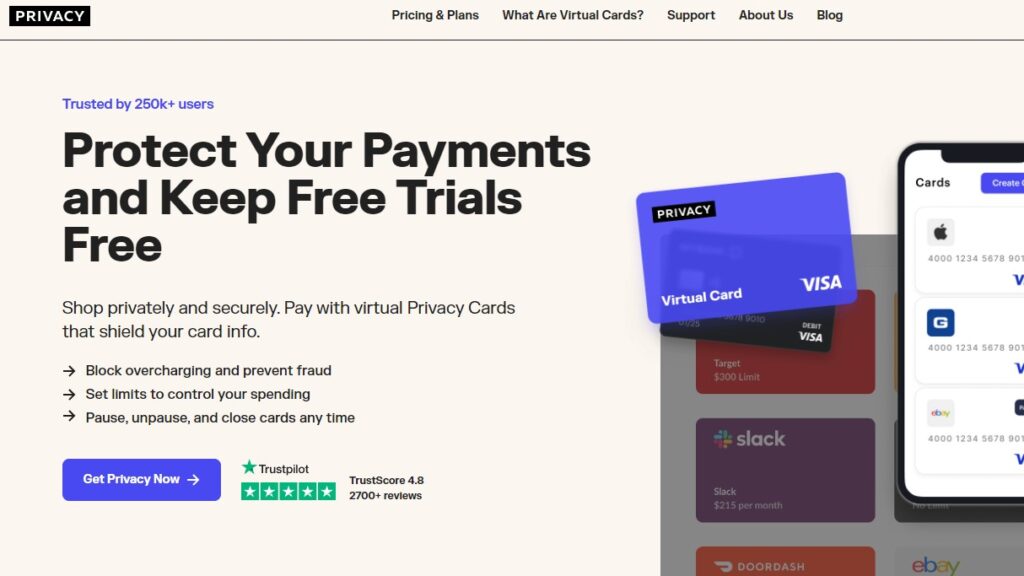

Privacy Virtual Card

Privacy Virtual Card: Privacy is a service that generates virtual cards linked to users’ existing debit or credit cards, providing an extra layer of security for online purchases. Privacy virtual cards allow users to create unique card numbers for each online transaction, reducing the risk of fraud and unauthorized charges. They also offer customizable spending limits and the ability to deactivate virtual cards to prevent further charges easily.

Practical Advice on Using Virtual Cards

When it comes to utilizing virtual cards, prioritizing safety is paramount. To safeguard your financial information, it’s advisable to only use virtual cards on trusted and secure websites with HTTPS encryption. Additionally, consider enabling two-factor authentication for added security. Regularly monitoring your virtual card transactions is essential to detect any suspicious activity quickly, and setting spending limits can help you stay within your budget and prevent overspending.

Conclusion

In conclusion, virtual cards offer a convenient and secure solution for online shopping. By leveraging virtual cards, users can enjoy the ease of making purchases without exposing their primary bank account or credit card details to potential risks. However, it’s crucial to choose the right virtual card that aligns with your individual needs and preferences.

Also See: Get Source Code of Webpage Free Online Tool

Factors such as security features, ease of use, and additional functionalities should be carefully considered when selecting a virtual card provider. With the right precautions in place and a reliable virtual card at your disposal, you can confidently navigate the digital landscape and make your online shopping experience both seamless and secure.